An investment in knowledge pays the best interest.

~Benjamin Franklin

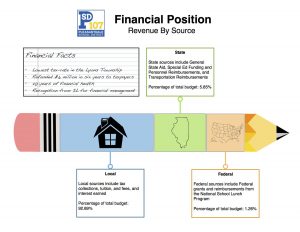

At the December 20 Board of Education meeting, the Pleasantdale Board approved the tax levy for tax year 2017. Being a public entity, Pleasantdale School District has few ways to raise revenue to support the high quality programs that our community demands. Local property taxes, our main source of revenue, make up over 90% of the district’s revenue. As required by state law, the district reviews the levy in a public hearing and the Board discusses if the proposed levy will meet the needs of our schools. Once approved, the levy is sent to the  Cook County Clerk, and the levy is adjusted to align with the consumer price index (CPI), and the 2017 equalized assessed property values. At that point, the new tax rate is applied to the value of each property within the county. The Pleasantdale Board of Education has set a standard that every dollar collected should have a positive impact on students. To that end, over 80 cents of every dollar collected goes directly to student instruction through salaries and benefits. Another 10 cents of every dollar collected supports our facilities, and the final dime per dollar collected is allocated to transportation and to pay off debt.

Cook County Clerk, and the levy is adjusted to align with the consumer price index (CPI), and the 2017 equalized assessed property values. At that point, the new tax rate is applied to the value of each property within the county. The Pleasantdale Board of Education has set a standard that every dollar collected should have a positive impact on students. To that end, over 80 cents of every dollar collected goes directly to student instruction through salaries and benefits. Another 10 cents of every dollar collected supports our facilities, and the final dime per dollar collected is allocated to transportation and to pay off debt.

The Board of Education understands the responsibility of being a taxing body and does not take this responsibility lightly. In fact, Pleasantdale residents enjoy the lowest tax rate in all of Lyons Township. Additionally, students in our schools get an exemplary educational experience and produce amazing results. Our schools offer a rigorous core curriculum aligned to state standards as well as a robust arts, music, and world language program. This makes Pleasantdale the best value or “bang for your buck” in the Lyons Township. Additionally, our families enjoy free bus transportation which has brought our ridership to 80% districtwide. Our students at both schools enjoy a broad menu of extracurricular activities, all of which are offered free of charge. Finally, the Board has directed the administration to refund over $6 million (over the past seven years) to the community through a bond abatement which lowers the tax rate for our residents.

As you can see, the Pleasantdale Board of Education has done a masterful job of balancing the need to keep costs low with the need to raise funds through the annual tax levy. The Board of Education is able to prioritize dollars spent and pass savings on to the residents of the Pleasantdale community. As Illinoisans, we are no stranger to taxes, but it is comforting to know that your local School Board is doing all it can to lessen the impact of your tax bill. As the Board continues to be responsible financial stewards, it will look for new ways to provide our community with the best educational experience for their children and also keep costs reasonable.

Leave a Reply